Gift Limits For 2024

Gift Limits For 2024. 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000. Most people don’t have to worry about this tax thanks to annual and lifetime exclusions.

Remaining lifetime exemption limit after gift: In this section, we will provide you with an overview of the gift tax exemption limits for the year 2024.

The Gift Tax Is Imposed By The Irs If You Transfer Money Or.

It’s important to stay up to date with the most recent changes to the gift tax limits.

The Exclusion Limit For 2023 Was $17,000 For Gifts To Individuals;

Gift tax limits for 2022.

It’s Essential To Understand The Rules, Limits, And Guidelines Surrounding It, Especially As They May Change From Year To Year.

Images References :

Source: janeenqvanessa.pages.dev

Source: janeenqvanessa.pages.dev

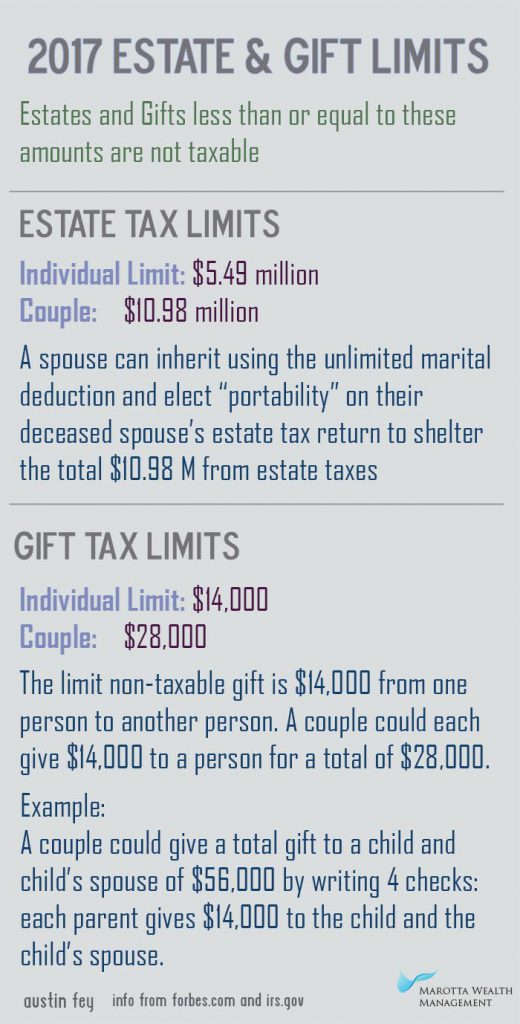

Annual Gifting Limits 2024 Lynn Sondra, Explore the increased irs gift and estate limits for 2024. The annual gift tax exclusion (the amount that may gift to one individual without needing to file a gift tax return) has increased from $17,000 in 2023 to.

Source: www.insidepoliticallaw.com

Source: www.insidepoliticallaw.com

California Raises Campaign Contribution and Gift Limits for 20232024, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient. For a married couple, this means they can jointly gift $36,000 to a single recipient without incurring gift taxes.

Source: www.magnifymoney.com

Source: www.magnifymoney.com

Gift Tax Limits for 2023 Annual and Lifetime MagnifyMoney, In this article, we’ll explore the gift tax, its. And because it’s per person, married couples.

Source: www.shastamountainrealty.com

Source: www.shastamountainrealty.com

2023 IRS TAXFREE gift limits • Shasta Mountain Realty, These gifts can include cash as well as other types of. The 2024 lifetime gift limit is $13.61 million.

Source: laptrinhx.com

Source: laptrinhx.com

Receive the Gift of Limits LaptrinhX / News, This means that you can give. 2024 lifetime gift tax exemption limit:

Source: quantumtrends.substack.com

Source: quantumtrends.substack.com

Gift Limits Taxes QUANTUMTRENDS’s Newsletter, The 2024 regulations allow an individual to gift up to $12.92 million over their lifetime without triggering the gift tax. 2024 lifetime gift tax exemption limit:

Source: campaignlawyers.com

Source: campaignlawyers.com

Gift Limits Sutton Law Firm, Explore the increased irs gift and estate limits for 2024. If a gift surpasses the annual limit, the excess is.

Source: www.marottaonmoney.com

Source: www.marottaonmoney.com

2017 Estate and Gift Tax Limits Marotta On Money, The exclusion limit for 2023 was $17,000 for gifts to individuals; Remaining lifetime exemption limit after gift:

Source: tybieqcoralyn.pages.dev

Source: tybieqcoralyn.pages.dev

Indiana 529 Contribution Limits 2024 Faythe Cosette, 2 you’ll have to report any gifts you give above that amount to the. Gift tax limits for 2022.

Source: offitkurman.com

Source: offitkurman.com

2020 Estate and Gift Taxes Offit Kurman, The tax applies whether or not the donor. In 2023, the lifetime gift tax limit was $12.92 million.

It’s Important To Stay Up To Date With The Most Recent Changes To The Gift Tax Limits.

(that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted.

Spouses Can Elect To “Split” Gifts,.

We will examine how the rules work and explore strategies to minimize your.