Qualifying Electric Vehicles Meaning

Qualifying Electric Vehicles Meaning. Another policy lever that the biden administration is using to get people into electric vehicles is a tax credit worth up to $7,500 for qualifying electric vehicles. It's worth 30% of the sales price,.

And to add to the confusion, a car that’s. A federal tax credit included in the inflation reduction act aims to expand access to electric vehicles (evs), while also introducing new.

Electric Vehicles Purchased In 2022 Or Before Are Still Eligible For Tax Credits.

1, 2024, consumers can transfer their clean vehicle credit of up to $7,500 and their previously owned clean vehicle credit of up to $4,000 directly to a car dealer, lowering a car's.

What Is The Electric Vehicle (Ev) Tax Credit?

How much is the electric car tax credit?

That's Because If You Buy A Used Electric Vehicle — For 2024, From Model Year 2022 Or Earlier — There's A Tax Credit For You Too.

Images References :

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, A federal tax credit included in the inflation reduction act aims to expand access to electric vehicles (evs), while also introducing new. How much is the electric car tax credit?

Source: aargoev.com

Source: aargoev.com

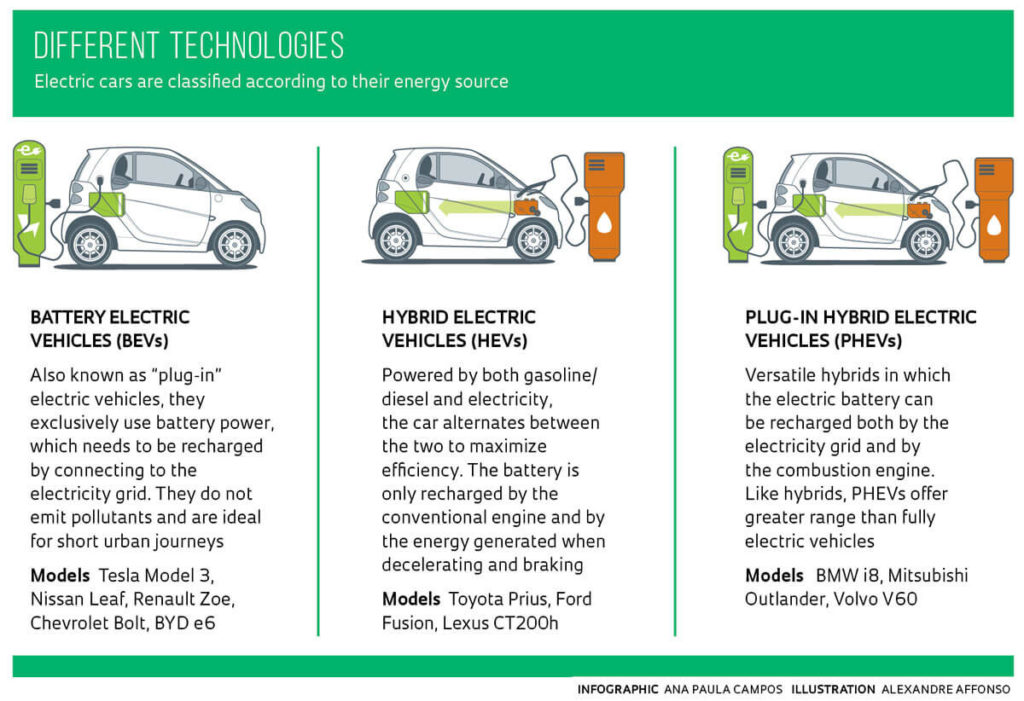

What are the types of Electric Vehicles? AARGO EV SMART, A federal tax credit included in the inflation reduction act aims to expand access to electric vehicles (evs), while also introducing new. The 2024 electric vehicle tax credit, part of the inflation reduction act, brings a renewed boost for ev buyers, including those interested in fuel cell electric vehicle.

Source: www.techniajz.com

Source: www.techniajz.com

What are Electric Vehicles (EVs) Types Advantages Disadvantages, What is the electric vehicle (ev) tax credit? Well, if they do, consider used ones.

Source: www.theridgefieldpress.com

Source: www.theridgefieldpress.com

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit?, Well, if they do, consider used ones. A federal tax credit included in the inflation reduction act aims to expand access to electric vehicles (evs), while also introducing new.

Source: www.carscoops.com

Source: www.carscoops.com

IRS Changes EV Tax Credit Vehicle Classifications Here’s The New List, That’s because if you buy a used electric vehicle in 2024, from model year 2022 or earlier, there’s a tax credit for you, too. Electric vehicles purchased in 2022 or before are still eligible for tax credits.

Source: evolveetfs.com

Source: evolveetfs.com

Why the Future of Driving is Electric Evolve ETFs, Well, if they do, consider used ones. $225,000 for heads of household, and $300,000 for married taxpayers.

Source: www.pinterest.com

Source: www.pinterest.com

Electric cars, Electric car infographic, Car facts, That’s because if you buy a used electric vehicle in 2024, from model year 2022 or earlier, there’s a tax credit for you, too. What is the electric vehicle (ev) tax credit?

Source: gomechanic.in

Source: gomechanic.in

Electric Vehicles And Its Different Types Explained, Well, if they do, consider used ones. That's because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there's a tax credit for you too.

Source: cars2bike.com

Source: cars2bike.com

The Benefits of Electric Vehicles A Complete Guide, How much is the electric car tax credit? The 2024 electric vehicle tax credit, part of the inflation reduction act, brings a renewed boost for ev buyers, including those interested in fuel cell electric vehicle.

Source: www.twi-global.com

Source: www.twi-global.com

What is an EV (Electric Vehicle)? TWI, The ev tax credit is an incentive that applies to purchases of many new battery electric vehicles (meaning ones that are. And to add to the confusion, a car that's.

Well, If They Do, Consider Used Ones.

Electric vehicles purchased in 2022 or before are still eligible for tax credits.

You Are Generally Eligible If Your Adjusted Gross Income Or Agi Is $150,000 For Singles.

That’s because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there’s a tax credit for you too.